Xcel seeks rate increase despite growing profits

Last year, Xcel filed a request to increase electric rates for Minnesota customers. If the request is approved as is, the typical customer's bill will go up by $10.27 per month, or $123.37 per year.

Xcel's Electric Rate Increase

Last November, Xcel Energy filed another request to increase rates for its Minnesota electric customers. The increase would add an additional $$474 million to customers’ tab over the next two years.

Minnesotans are angry about this request. In the two months since Xcel sent a notice to its customers alerting them to the requested rate increase, over 5,000 people have filed public comments—the vast majority of whom strongly oppose the rate increase. Many of the public comments complain that Xcel is seeking to raise rates to unnecessarily increase corporate profits. This article unpacks that complaint by taking a closer look at Xcel’s recently reported earnings.

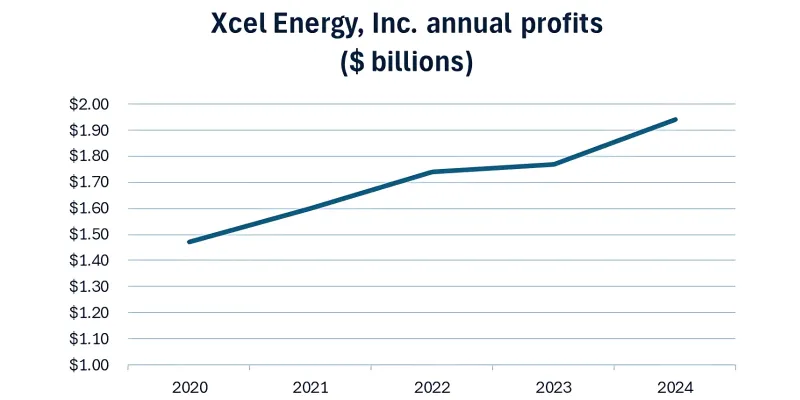

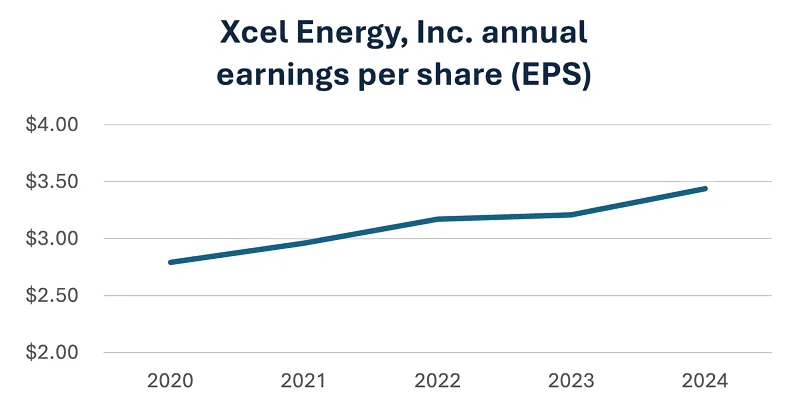

On February 6, 2025, Xcel released its annual earnings report for 2024. In it, the company reported $1.94 billion in annual profits—or $3.44 in earnings per share (EPS) of outstanding Xcel stock— for 2024. A review of similar reports for prior years reveals that Xcel’s profits have climbed in at least each of the past five years.

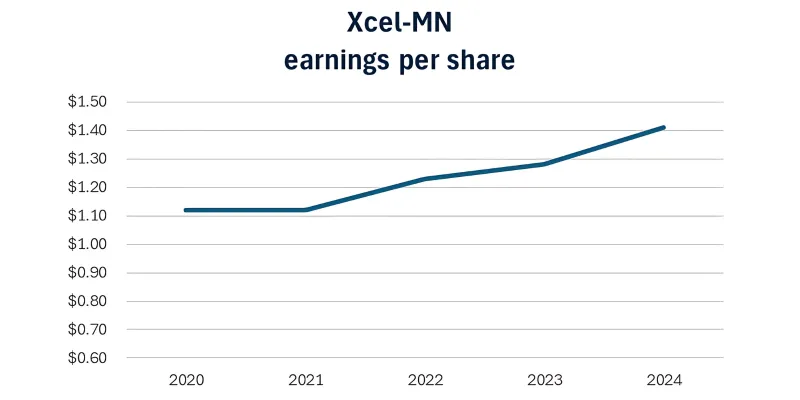

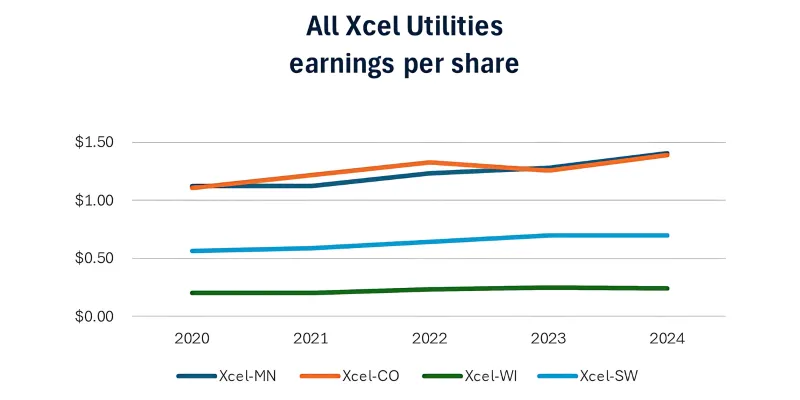

Xcel owns four utility companies that operate in 8 states (Minnesota, Colorado, Wisconsin, Michigan, North Dakota, South Dakota, Texas and New Mexico). Earnings from each of those utilities contribute to Xcel’s overall earnings. Xcel's Minnesota utility has, itself, reported stable or increasing earnings per share over the past five years.

Moreover, the earnings per share for Xcel's Minnesota utility appear to be on a stable and growing trajectory relative to Xcel’s other regulated utilities.

What do these reported earnings mean in the context of Xcel’s pending rate case?

In its current rate case, Xcel claims higher rates are needed to support additional capital investments, keep up with growing demand for electricity, and to modernize and strengthen Xcel’s transmission and distribution systems. However, other factors drive Xcel’s latest rate increase request.

Notably, Xcel is again requesting a significant increase to its authorized return on equity (ROE). Authorized ROE helps determine how much money the utility is permitted to collect from its customers in order to distribute profits to its shareholders. At a simple level, the higher the authorized ROE, the more customers pay, and the more shareholders profit. Xcel seeks to increase its authorized ROE from 9.25 percent to 10.3 percent—a significant increase that, if approved, would require collecting approximately $100 million more per year from Minnesota customers. This is a bold request that has little chance of approval: Minnesota’s PUC has not approved an authorized ROE above 10 percent for any regulated utility in at least a decade.

In Xcel’s last electric rate case, Xcel requested a 10.2 percent ROE, but the PUC authorized a much lower, 9.25 percent ROE. When the PUC announced this decision in June of 2023, Xcel reacted angrily. An Xcel representative suggested that the company would reassess its ability to lead Minnesota’s clean energy transition. Xcel also claimed the PUC’s decision caused Xcel’s stock price to go down. Now, after a year and a half of Xcel’s Minnesota utility operating with a 9.25 percent authorized ROE, Xcel expects to meet Minnesota’s carbon-free law five years ahead of schedule, and Xcel’s stock price is higher than what it was in the months just prior to the PUC’s 2023 decision.

It also appears a 9.25 percent ROE has not negatively affected Xcel’s credit rating, financial integrity, or ability to attract capital. Xcel’s earnings reports show that credit ratings for its Minnesota utility have remained stable over the past five years. Xcel’s Board of Directors just voted to increase its quarterly dividend —the twenty second consecutive year that it has done so—showing Xcel continues to maintain strong financial integrity. Xcel press releases suggest Xcel has successfully raised significant capital in recent years. And, again, Xcel’s annual profits continue to rise.

If Xcel is able to attract capital, maintain financial integrity and credit worthiness, and increase profits with a 9.25 percent authorized ROE in Minnesota, how can the company justify the purported need for a substantial increase to its ROE? This is a question CUB will be asking during this rate case. Ultimately, Xcel has the burden to prove any authorized ROE appropriately balances the regulated utilities’ opportunity to earn a reasonable return with utility ratepayers’ right to pay just and reasonable rates. Minnesota law requires that doubt over the reasonableness of Xcel’s rates must be resolved in ratepayers’ favor.

At a time when we are seeing high numbers of Minnesotans experience utility disconnections as they struggle to afford their bills, Xcel’s authorized ROE should go down, not up: it is already set higher than is needed for Xcel to earn a reasonable return at its customers’ expense.

Get involved

If the issues discussed here frustrate you, get involved and make your voice heard. If you're concerned about Xcel's request to raise electric rates, you can submit a comment to the PUC by clicking the button below. Or, send an email to consumer.puc@state.mn.us and be sure to reference Docket 24-320. Your comment— including your name, email address, and any other information you share—will become a part of the public record. Here are some tips to make your comment as effective as possible.