Judge strongly recommends that Acquisition of Minnesota Power be denied

Read all of our writings on the proposed acquisition of Minnesota Power here.

As we have previously discussed, ALLETE, Inc. (the company that owns local utility Minnesota Power) has reached a deal to be acquired by two large, private investors: the Canada Pension Plan Investment Board and BlackRock’s Global Infrastructures (collectively, the Partners). On July 15, a judge reviewing the proposed acquisition issued a strongly worded report that decisively recommends the Minnesota Public Utilities Commission (PUC) deny its approval. The judge’s report reveals three different stories that ALLETE and the Partners are telling about the acquisition. This article discusses those three stories, and why understanding each of them is critical to forming an informed opinion on the potential benefits vs. risks of approving the acquisition. Ultimately, the judge’s report strongly reaffirms and supports CUB’s recommendation that the acquisition be denied.

Story 1: ALLETE overstates the purported benefits of the acquisition

The first (and primary) narrative is the public story ALLETE’s leadership and supporters are sharing in press releases, public statements, and public filings with the PUC. This story justifies the acquisition as being a positive step forward for the company, its customers, and northern Minnesota communities mostly because ALLETE claims it will enable the company to access the capital it needs to achieve Minnesota's Carbon Free Standard. According to this story, ALLETE chose to work with the Partners because of those entities’ “shared values” and commitment to the renewable energy transition. This story also highlights numerous commitments ALLETE and the Partners have made, purportedly to benefit Minnesota Power and its customers and to alleviate concerns raised by parties opposed to the acquisition.

The judge’s report is dismissive of this story for a number of reasons—most notably because it is inconsistent with statements made by the Partners that are hidden from public view. According to the judge, “[i]n considering the true risks and benefits of the Acquisition, it is critical that the Petitioner’s agreements and private discussions do not comport with their public statements.”

The judge also finds the Partners’ “commitment” to provide capital to ALLETE to be overstated:

The Partners themselves have carefully committed to do very little, instead largely making commitments through expected holding companies or Minnesota Power itself. A prime example of this phenomenon is the promised funding of the five-year capital plan. Access to capital is the primary benefit touted by the Petitioners. However, the Partners have not, in fact, promised to provide capital to ALLETE. ALLETE did not even ask for some commitment to provide equity as part of this merger negotiation and the merger agreement did not require the Partners to provide ALLETE with any additional equity.

In a summary of public comments attached to the Report, the judge also dismissed the perspectives of several community organizations that expressed support for the acquisition, finding their support to be grounded in relationships with Minnesota Power and its staff, not a review of the actual acquisition:

Comments in support of the Acquisition largely repeated the Petitioner’s employee and public messaging about the Acquisition - expressing that it will provide Minnesota Power with the capital needed to satisfy the Carbon Free Standard while continuing to be a positive presence in the local community. Commenters frequently noted trust in the current leadership of the Company. Numerous commentors in support of the Acquisition were Minnesota Power employees. Many other supportive commentors were from nonprofit or community organizations that receive funds from Minnesota Power. These commentors often indicated support for Minnesota Power but did not comment in the merits of the transaction itself. It is unclear whether these individuals felt obligated to support Minnesota Power due to the financial support they are provided by the company.

The judge was also skeptical of the “commitments” ALLETE and the Petitioners offered to assuage concerns raised by parties opposed to the acquisition:

The proposed commitments offered by Petitioners do not rebalance the transaction to avoid net harm. Many of the commitments simply restate existing legal requirements and therefore do not provide additional protections to counterbalance new risks arising as a result of the Acquisition. Some of the proposed conditions may be unenforceable. And others offer little benefit to ratepayers or the regulatory compact. It also appears that many of the Petitioners’ proposed commitments are out of step with other recent take-private transactions involving utilities.

Further still, the judge was not convinced by one of the main arguments those who support the acquisition have repeated throughout this process—that Minnesota Power will remain subject to the PUC’s oversight and, therefore, Minnesota Power’s customers will be protected from unreasonable price hikes pursued by sophisticated institutional investors. According to the judge:

While the proposed acquisition would not change the Commission’s authority over ALLETE, new ownership could increase the difficulty of regulating the utility if the utility becomes less cooperative or transparent. Throughout this proceeding, the Partners have objected to many information requests, provided nonresponsive answers, provided heavily redacted responses, and employed tiered trade-secret designations that hampered intervenor review.

[. . .]

The Partners’ lack of cooperation in this proceeding further establishes a material risk that ALLETE’s transparency may suffer under their ownership. Any reduction in cooperation by the utility would harm the public interest by increasing the burden on regulators and the likelihood of worse regulatory outcomes for ratepayers.

Finally, the Judge was dismissive of a settlement stipulation the Minnesota Department of Commerce unexpectedly agreed to just days before the judge issued her report:

On July 11, 2025, just days prior to the due date for this Report, the Department and the Partners filed a settlement stipulation. While the timing of the filing did not allow adequate time for the Administrative Law Judge to incorporate this development into Report, and this Report does not explicitly consider the settlement agreement, the Administrative Law Judge has reviewed the stipulation and notes that her concerns regarding the Acquisition have not been resolved and it does not change the Administrative Law Judge’s recommendation to disapprove the Acquisition.

Story 2: The acquisition wasn’t needed… until the price was right for ALLETE’s shareholders

The second story is the public story ALLETE’s leadership is telling its shareholders and investors in filings made with the Securities and Exchange Commission. In this narrative, ALLETE reports to its shareholders and securities regulators—at risk of serious legal consequences for making false or misleading statements—that it already has access to the capital it needs, and that ALLETE would have walked away from the acquisition if the Partners had not increased their offer price. Specifically, despite ALLETE’s filings with the PUC expressing concerns about their inability to raise sufficient capital if the deal is not approved, ALLETE’s last two 10-K annual reports—which were prepared with the assistance of sophisticated legal counsel and signed by ALLETE’s CEO, CFO, and full Board of Directors—clearly state that ALLETE expects to meet its capital needs via existing strategies and its access to public markets (access that would go away if the acquisition is approved). The judge highlighted these statements in her Report:

ALLETE’s professed doubts about public market adequacy conflict with statements made to investors in its annual SEC filings. In its 2023 annual report, ALLETE told investors that it had adequate access to capital markets. Most recently, in its 2024 annual report filed in February 2025, ALLETE again confirmed that it is “well positioned to meet our financing needs due to . . . access to capital markets.” Both the 2023 and 2024 10-K filings were signed by ALLETE’s Chief Executive Officer, Chief Financial Officer, and every member of ALLETE’s Board of Directors.

ALLETE also prepared a detailed proxy statement to explain the proposed acquisition to its existing shareholders prior to a shareholder meeting. The proxy statement reveals that ALLETE “chose” the Partners when no other prospective buyers had made an offer. Even then, ALLETE rejected the Partners’ first two offers—including a second offer that was then-characterized as a “best and final” offer—because the offer price wasn’t high enough. (To be clear, those first two offers were both above ALLETE’s market value.) ALLETE ultimately accepted a third offer after the Partners increased their offer price to an amount up to 22% above the market value of the Company. The judge highlighted this in her Report:

In negotiating the merger agreement with the Partners, ALLETE required a substantial premium to its market value. ALLETE rejected the Partners’ initial offer of $62.50 per share and their second offer of $64 per share before accepting a third offer of $67 per share. The last price reflects a 19 percent to 22 percent premium over the ALLETE common stock share price prior to news of the proposed acquisition influencing that price. The $67 per share price also reflects a premium of $1.5 billion over ALLETE’s book value.

[…]

While Minnesota Power publicly claims the Partners were intentionally and strategically chosen based on their alignment with Minnesota Power’s sustainability strategy and company's core values, the evidence shows the Partners were ultimately the only bidders for the company and were chosen based on their willingness to pay a stock premium.

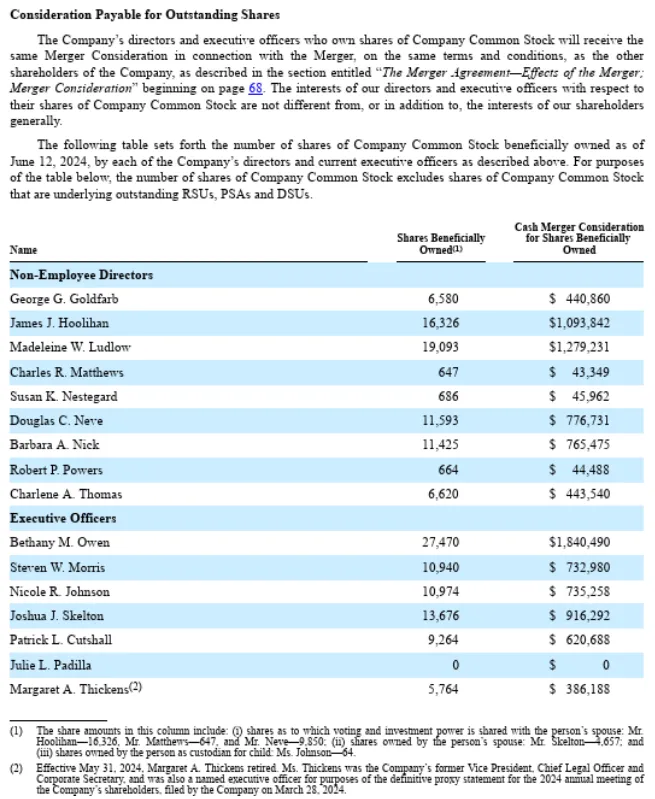

The Proxy Statement also shows that negotiating a higher offer price will clearly benefit ALLETE’s current shareholders, including the officers and directors that negotiated a higher offer price:

On the other hand, the acquisition premium will not benefit Minnesota Power’s ratepayers. Instead, it will put more pressure on the Partners to recoup that premium before they can earn any return on their investment. Because Minnesota Power represents a large share of ALLETE’s overall operations, the revenue needed to recoup the premium will need to be collected, in part, through Minnesota Power rates. This should concern ratepayers, stakeholders, and the PUC, because, unlike ALLETE, the Partners are not in the business of providing safe, reliable, and affordable electric service to northern Minnesotans; they are in the business of making strategic investments that generate a return for their clients and fund investors. The judge highlights this in her report:

As discussed elsewhere, concerns are present and plausible that the Partners will try to earn those higher returns for their investors using operational, governance, and financial engineering strategies. The Partners’ disavowal of “stereotypical” private equity tactics such as “debt leveraging, cost-cutting operational changes, and asset sales” to achieve their desired returns lacks credibility.

If the Partners employ financial engineering strategies to increase the returns they earn [. . .], the likely result is extra debt that causes ALLETE’s cost of capital to rise, which would result in rates that are higher than they otherwise would have been absent the proposed acquisition.

Story 3: Privately, the Partners have stated their intent to collect unreasonable profits from their investment in ALLETE

The third story is the private story the Partners are telling themselves about their goals and motivations for Acquiring ALLETE. This story is hidden from the public—and often ALLETE—behind trade secret designations. Only a few attorneys and witnesses from each party, the judge, and the Commissioners have access to the documents that tell this story. Unfortunately, this makes it difficult to discuss the full picture of the acquisition in a public forum. However, statements included in the public version of the judge’s report should alarm those who do not have access to the not-public version.

For example, the judge states:

The nonpublic evidence reveals the Partner’s intent to do what private equity is expected to do – pursue profit in excess of public markets through company control.

After summarizing the contents of presentations that document the Partners’ private assumptions and projections about ALLETE’s rates following approval of the acquisition, the judge notes:

The Partners’ private memoranda, modeling, and communications with potential investors establish that the Partners are planning on significant rate increases that will likely exceed the long-run rate of inflation. These increases, if permitted by the [PUC], would likely be detrimental to the economic competitiveness of ALLETE’s largest mining and industrial customers, and would cause electricity costs to increase as a percentage of residential customer incomes. The Acquisition creates an unacceptable risk of rate increase and rate shock in a critical and economically vulnerable area of Minnesota. [emphasis added]

Alarmingly, the judge also determined that ALLETE’s leadership does not understand the degree of control the Partners will have over ALLETE if the acquisition is approved:

The record reflects that ALLETE does not understand key governance terms discussed in [a trade secret term sheet prepared by the Partners]. [. . .] This demonstrated lack of understanding suggests that ALLETE does not fully appreciate how much control the Partners will have over its post-transaction affairs.

Finally, the judge questions the Partners’ credibility due to their use of improper redactions to initially shield information from even her review and their claim that a legal document central to the terms of a $6.2 billion deal negotiated by sophisticated parties with sophisticated legal counsel contains a fundamental drafting error:

[T]he Partners’ conduct in the course of this proceeding also raises cause for concern. Documents containing information highly relevant to the Partners’ intentions were improperly redacted and only produced after an in-camera inspection by the Administrative Law Judge. Additionally, during the evidentiary hearing the Petitioners improperly attempted to introduce a new agreement, drafted the night before, after extensive cross-examination about the existing document and the Partners’ control over the future ALLETE board of directors. The Administrative Law Judge finds absolutely no credibility in the assertion that the existing document contained a “drafting error” and instead finds that the admitted exhibit . . . reflected the intent of the parties. The Partners are the definition of sophisticated parties and the privileged log review by the Administrative Law Judge alone reveals the involvement of numerous skilled national law firms and dozens of attorneys in this matter.

The Judge’s Report establishes the Acquisition is not in the public interest.

All told, after reviewing an evidentiary record that took the better part of a year to compile, a judge—acting as neutral fact-finder—decisively and strongly recommended that the PUC deny approval of the acquisition. The following statement succinctly summarizes the judge’s reasoning:

The proposed deal is inconsistent with the public interest [. . .] because it results in net harm to the public interest.

The Petitioners have not established it is more likely than not that the deal’s possible benefits will be realized or that they equal or outweigh the risks of harm. In terms of benefits, Petitioners have not shown that the Acquisition will improve ALLETE’s access to capital or even whether ALLETE needs improved access. The other putative benefit identified by proponents of the deal is access to the Partners’ expertise. This benefit appears to have limited value given the Partners’ assurances that they intend to maintain ALLETE’s existing management, staff, and business plan. Weighing against these possible benefits, there are foreseeable risks of harm to the energy transition, ALLETE’s long-term financial health, and ratepayers. On balance, the risks of the deal, as proposed, outweigh the possible benefits.

What happens next?

Though the PUC is not bound to follow the judge’s recommendation, the judge’s report is now a significant part of the evidentiary record that the PUC will review. This fall, the PUC will hold a public hearing where they will ask questions of the parties to this proceeding and vote on a decision to approve, approve with conditions, or deny the acquisition.

In the meantime, the PUC has issued two notices requesting comments. One notice establishes a timeline for parties to respond to the judge’s report. The other notice requests comments on the settlement stipulation entered into by the Department of Commerce, ALLETE, and Partners. Initial comments responsive to both notices are due August 4th.

Get Involved

Anyone interested in submitting a written comment on the judge’s report and/or responding to the PUC’s notice requesting comments on the settlement stipulation can do so by emailing consumer.puc@state.mn.us, or following the PUC’s instructions here. If you submit a comment, be sure to reference PUC Docket Number 24-198, and know that everything included in your comment will become part of the public record.

Keep an eye on our website—and sign up for our newsletter—for additional updates as we work through this process.