CUB, Minnesota PUC, and others oppose efforts to cancel Midwest transmission projects

In July 2025, utility regulators in five states asked the federal government to undo years of progress towards transmission expansion in the Midwest region. The portfolio of projects at issue was developed after an extensive planning process and is necessary to protect the reliability of the electric grid. If these projects were to be delayed, it would take longer to bring new generation online, and electricity costs would likely increase.

The Minnesota Public Utilities Commission (Minnesota Commission) resoundingly decided to oppose this challenge in a public hearing last week. CUB has joined consumer advocates from across the mid-continent in doing the same. Minnesota’s agencies, transmission owners, and utilities have likewise made similar filings.

What is Tranche 2.1?

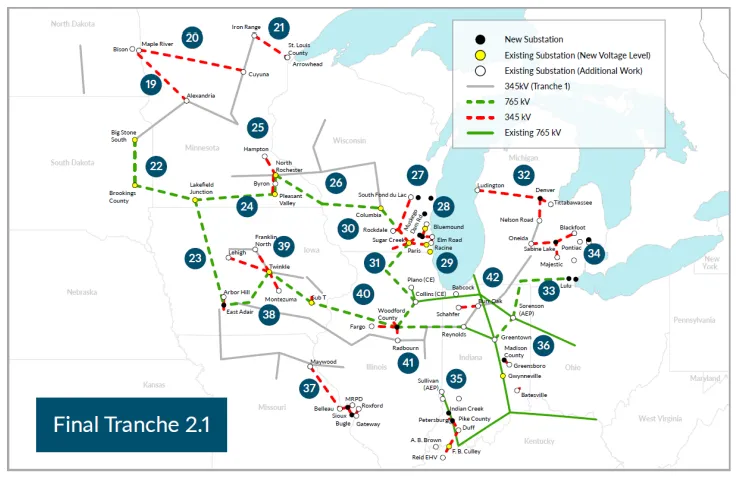

The Midcontinent Independent System Operator (MISO) oversees the regional transmission grid and is tasked with ensuring electricity flows “reliably and affordably across 15 states and the Canadian province of Manitoba.” In that role, MISO conducts analyses to determine whether transmission upgrades are needed to serve the electricity needs of its member states. “Tranche 2.1,” a portfolio of 24 transmission projects spread across the Midwest, was the result of one such planning process. As CUB explained in a prior article, Tranche 2.1 is expected to provide cost savings for customers, increase grid reliability, and deliver economic and job creation benefits that substantially exceed anticipated costs.

What is the complaint?

A coalition of state utility commissions recently challenged the cost-benefit analysis used to justify Tranche 2.1. In their complaint filed with the Federal Energy Regulatory Commission (FERC), the commissions of North Dakota, Montana, Arkansas, Mississippi, and Louisiana (collectively referred to as the Complaining Commissions) argue that projected benefits are overstated, and that their states should not be forced to contribute to the costs of project development. The Complaining Commissions suggest Tranche 2.1’s benefits were driven by the resource needs and decarbonization goals of other states within MISO and, because their states do not have any such goals, they should not pay for any of the transmission projects.

These arguments are misplaced. First, most of the commissions arguing against Tranche 2.1 are already excluded from paying for the projects. Within MISO’s footprint, the costs of transmission projects with wide-ranging benefits are split amongst different subregions. Tranche 2.1 focuses on the Midwest, which excludes Arkansas, Mississippi, and Louisiana. None of the projects are located in these states, and none of the costs will be borne by them.

Apart from this, the value of Tranche 2.1 is not solely associated with renewable energy or reductions in greenhouse gas emissions. As numerous parties attested to at the Minnesota Commission’s hearing, these projects are necessary to provide reliable, efficient, and affordable electricity service to households and businesses throughout the MISO Midwest subregion, including in North Dakota and Montana. As Matt Ellis with Great River Energy explained, “[w]hile the complaint primarily highlights the economic analysis supporting the portfolio . . . reliability is the principal driver of need.” He went on to reiterate that Tranche 2.1 would resolve 961 known reliability constraints, increasing the safety and dependability of the electricity system as a whole. Xcel Energy’s Ian Dobson further added that the money saved by addressing these issues would offset at least half of the portfolio costs, before considering any of the other benefits of Tranche 2.1.

Stacie Hebert of Otter Tail Power Company likewise weighed in, noting that one of the Tranche 2.1 transmission projects contemplated for their service territory would “form[] a bridge across . . . the eastern side of North Dakota and the northwestern portion of Minnesota, allowing access to low-cost power” and addressing more than 60 percent of the reliability concerns in the area.

Resolving these sorts of issues is “exactly what the MISO process is designed to address,” said Joseph Sullivan, Vice-Chair of the Minnesota Commission and President of the Organization of MISO States (OMS).

How was Tranche 2.1 developed?

The process for designing and approving Tranche 2.1 was extremely robust, with several hundred meetings across multiple years. Utilities, commissions, ratepayer advocates, transmission owners, and other stakeholders all had numerous opportunities to be heard and contribute to the development of the portfolio. Minnesota Commissioner Ham, who worked extensively on transmission issues in MISO prior to his appointment to the PUC, expressed that this sort of collaborative process is an “upper-Midwest tradition.”

As Stacie Hebert describes, the “[u]tilities with the best knowledge of the needs in their area can submit solutions for consideration.” The firsthand knowledge of these parties is essential to identifying the shortcomings of the existing grid so that new projects can be built to serve the ever-increasing needs of households and businesses.

Indeed—despite now arguing against Tranche 2.1—the North Dakota Public Service Commission advocated during one of these meetings for “enhance[d] . . . transmission infrastructure” to connect the strong “wind resources in central and western North Dakota” to the broader grid. MISO responded by tripling the amount of wind sited in the area to ensure those resources would not be stranded.

It is this sort of iterative approach that builds a strong foundation for Tranche 2.1. By evaluating multiple alternatives and weighing different options, the most cost-effective transmission projects can be identified for approval. As Vice-Chair Sullivan recognized, working together in this way makes a lot of sense, “because it costs less . . . than it does if we do ad hoc[], one-off[] approaches.”

Importantly, initial approval of these projects at MISO does not lessen the amount of scrutiny they are subject to at the state level. Individual transmission lines still must undergo extensive review processes to ensure they are needed and cost-effective solutions to grid problems. Numerous agencies, landowners, and stakeholders like CUB are involved in these proceedings.

What are the benefits of Tranche 2.1?

At a high level, Tranche 2.1 will form a backbone for the transmission system and enable electricity to be reliably and cost-effectively transported from where it is produced to where it is used. This allows customers to access lower-cost energy resources and reduces the need for excess generation. While the portfolio of transmission projects is expensive—coming in at an estimated cost of $21.8 billion—these costs are spread across the entirety of the Midwest region and are substantially less than the anticipated benefits.

MISO expects that for every dollar spent, between $1.80 and $3.50 in benefits will be created. In total, the portfolio is expected to produce up to $72.4 billion in net savings over the next 20 years. Many of these benefits will directly help to lower customers’ energy bills and increase the reliability of the electric grid.

- As discussed above, resolving reliability concerns is a core reason for moving forward with Tranche 2.1. Mitigating these issues is expected to provide benefits of between $14.8 and $42.3 billion.

- The transmission expansion enabled by Tranche 2.1 will allow lower-cost resources from further away to be used to power homes and businesses. MISO estimates that optimizing these resources could reduce generation costs by up to $16.3 billion as compared to wholly local buildouts of resources.

- If not enough transmission capacity is available, then lower-cost energy cannot be added to the grid. When this happens, higher-cost energy that is geographically closer to customers will be used instead. Tranche 2.1 is expected to save customers approximately $8.1 billion in congestion and fuel cost savings over the next 20 years.

- Other benefits include avoiding future costs related to aging infrastructure and resources needs, mitigating extreme weather risks, and reducing pollution.

What are the long-term impacts of delaying or denying Tranche 2.1?

If MISO were forced to reconsider the Tranche 2.1 portfolio of transmission lines, it would result in significant planning delays and potentially threaten the viability of new energy projects. Recently, an accelerated review process was approved by FERC to bring needed sources of energy online and mitigate reliability concerns in MISO. Many of these projects are dependent on Tranche 2.1 moving forward and would need to be reevaluated if the Complaining Commissions’ arguments are accepted. This would result in needless delays and potentially prevent generation projects from utilizing expiring federal tax credits, thereby driving up costs for customers throughout the region.

Even after being approved at MISO, transmission lines must go through extensive, months-long regulatory review processes at the state level. It then takes years to build the projects and interconnect energy resources. If FERC reverses MISO’s Tranche 2.1 approval, it could further hold up these projects. During that time, reliability problems will persist, and customers won’t be able to access lower-cost sources of energy.

Minnesota PUC, CUB and many others formally oppose the complaint.

After the conclusion of its hearing, the Minnesota Commission jointly filed comments with the commissions of Illinois, Michigan, and Wisconsin opposing the complaint. It also submitted a letter with the Minnesota Department of Commerce urging FERC to recognize the benefits of Tranche 2.1. Each of the other parties that testified at the hearing—including MISO and Minnesota’s electric utilities—likewise weighed in. We appreciate the proactive role that the Minnesota Commission and others have taken to addressing this complaint.

CUB has signed onto a letter with consumer advocates across MISO, urging FERC to acknowledge the reliability and cost-savings benefits associated with Tranche 2.1 and deny the Complaining Commissions’ requested relief. CUB is carefully paying attention to these developments and will continue to post updates as they become available.